It’s a well-known fact that regular and reliable invoicing means a healthier and more accurate cash flow. It’s crucial to the success of your business, so put the time and effort into making it as smooth a process as possible.

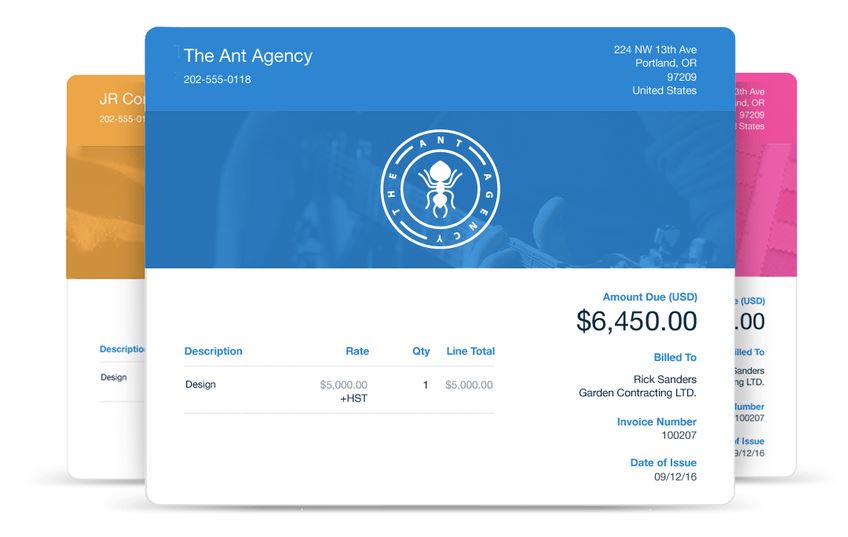

There are many digital tools and apps you can invest in to make your invoicing system as effective as possible, but there are also free services to use, for example, see freshbooks.com – here you can create simple invoice templates for free.

How you choose to invoice depends on the type of business you have, for example, online shops expect payment before the goods are posted, whereas services usually issue invoices after work has been delivered.

Send a professional invoice

Be clear on what needs to be included to create a professional invoice. If you’re using digital accounting software, this will often provide a template to make your invoices look more professional. Use your logo to ensure the invoice stands out and make sure all the information is correct and up to date. Always check and double-check figures, dates and details are correct before sending on to a client.

When to invoice

Decide when is the best time for you, as a business, to invoice. It may be once the project has been completed, but with regular clients, it might be beneficial to set up regular monthly or weekly payments. Knowing when you will receive money (and how much) can really aid cash flow and reduce stress.

Agreeing on payment terms

Before starting on a project, be sure to agree on payment terms and have a reliable contact for the financial department of the business you are working with. This should ease any delays or issues in the future. Usually, other small businesses pay regularly and quicker, compared to larger businesses that have more complicated accounting procedures in place.

Get support with your invoicing

Whether you choose to hire someone to take the role off your hands or invest in digital software to make the process easier, it’s worth having some support in this area. Some small businesses use accounting software to manage finances, although you’ll still need to input data and manually manage this system. Having the correct tools in place could help save you money, time and effort in the long run.

Be organized

Stay on top of your invoicing as much as possible with a reliable tracking system so you can see when payments have been made. Make sure every invoice has a specific number assigned to it, ask clients to use this when making a payment. If you have a digital system in place, this can register when payments have been reconciled and highlight which payments are still outstanding. Whether you choose to hire an extra pair of hands for accounting assistance or decide to invest in a digital support system, reliable and accurate invoicing will help you stay on top of payments, and most importantly, positively increase your business’ reputation.