Cryptocurrency may sound like a cryptic, otherworldly concept. But, it is actually much more simple than that. With the current hype about Bitcoin and Ethereum, it is necessary to actually understand what cryptocurrency is all about. In this article, we will provide you with explanations regarding cryptocurrency, its origin, certain technical aspects of it, as well as the current scenario.

Cryptocurrency: The Origin

Before we jump into the details of cryptocurrencies, let us first understand what cryptocurrency is and how is it different from actual currency.

The actual paper currency is something tangible, i.e., you can see it, touch it, and feel it. It is a physical object. Respective national governments regulate it. And, it is a means of exchange. Now, when we compare cryptocurrency to actual currency we are going to find only one similarity, i.e., it is also a means of exchange. However, unlike actual paper currency, cryptocurrency has no physical or tangible form. And, it is open to everyone as no one regulates it.

Since the meaning of a cryptocurrency is somewhat clear at this point in time, let us move to Bitcoin. We hope that we will be able to dispel any residual doubts (too many of those ought to be there at this point) along the way.

The First Ever Cryptocurrency

Remember Bitcoin? Released way back in 2009, Bitcoin was the first ever cryptocurrency. Satoshi Nakamoto invented it. However, one interesting thing to take note of is that no one knows who actually Satoshi Nakamoto is. The inventor of the Bitcoin used it as an alias and the actual person has never come into the spotlight. While releasing Bitcoin, Satoshi said that it is a new electronic cash system that uses a peer-to-peer network. Now, if we are to break down the technical jargon, it simply means that Bitcoin was invented as a new exchange system which was to be exchanged online between the parties doing the transaction without the involvement of any middleman. This eliminates banks, governments, and any other third party involved in maintaining and regulating cash.

Also Read – Everything you need to know about safely storing cryptocurrency

Nomenclature

Why is cryptocurrency called that? Isn’t it just another cash system which is digital rather than physical? Apparently, that is not the case. There is an entirely different way to maintain this currency. There are no private transactions. Each and every transaction that has been done using Bitcoin can be viewed by anyone who has access to the blockchain. What is a blockchain you ask? It is simply a chain of blocks of bitcoin transactions. A block is a list of Bitcoin transactions. And now we have an inception of transactions. It is easy to understand if we visualize it this way:

- A block is like a small book which has some number of Bitcoin transaction records in it.

- If we have a number of such books and all of those are linked, then we have a book chain or essentially the blockchain.

Now we know what cryptocurrency is. But, what is with this cryptic nomenclature? Well, it is a perfectly justified name. The “currency” part of the name is well understood by everybody. The interesting part is the “crypto” part. The method by which the transactions are done and secured is referred to by that part. Yes, you read that right. Cryptocurrencies make use of cryptography in order to perform transactions securely. Let us explain this a little more.

A Transaction Using Cryptocurrency

A transaction using cryptocurrency is secured using keys. There are two kinds of those – one is “public key” and the other is “private key”. Now, they aren’t actual physical keys to any locks. They are a random sequence of letters and numbers which uniquely identify a person (like a bank account number).

But why do we need two keys for a single person? Well because this is what helps in securing the transaction. A public key acts as an address or account number of the person to whom one wants to send money. Since it is done online, there are chances that the data sent can be intercepted. In order to prevent theft, the transaction made by a person is digitally signed by his private key. So, the senders’ private key and the receiver’s public key ensure that the transaction takes place only between them and no third party is able to tamper with it. That is a pretty slick idea, right?

But, one thing one may ask is, “Where do we store this cryptocurrency?” This is where wallets come in. A wallet is a program which keeps track of your transactions and thus maintains the record of your digital cash.

That is one of the strengths of cryptocurrency. Let us look into another one.

What is Mining?

One term which goes hand in hand with cryptocurrency is mining. And you probably have a general idea as to what mining is. Mining, which is related to minerals and ores, is to dig out the valuable resources from the earth. Similarly, cryptocurrency mining is the process of mining or unearthing the currency itself. Now, wait a minute. This doesn’t make any sense. How can we physically mine something which is not physical?

Well, this mining is not the physical mining. However, the name of the process is so. Cryptocurrency comes into existence when someone solves complex mathematical functions. One has to use specific mining hardware and computer architecture for this purpose. The reward for solving these functions is a fixed amount of the currency you are mining. For example, when Bitcoin was first created, the reward was 50 Bitcoins per block mined.

Doesn’t that mean that anyone with a computer can mine cryptocurrency? Well, technically yes, but, practically there are a lot of factors to account for. We will go into the details about mining cryptocurrency in another article where we will explain how to actually mine a popular cryptocurrency and the advantages as well as disadvantages of mining.

When it comes to mining, one thought that definitely comes to mind is that we can indefinitely mine cryptocurrency. How is it different from physical currency then? The answer to this question is pretty simple actually. There is a limit to the amount of a cryptocurrency which you can mine. This makes it so that cryptocurrency is not prone to inflation.

As you can see, we are piling up the benefits of cryptocurrency one by one.

Cryptocurrencies: Bitcoin and others

We can now be a bit complacent and say that our knowledge about cryptocurrencies is not much lacking. So let us take this knowledge as the base and explore the various cryptocurrencies currently in trend.

Bitcoin

As we have already revealed it earlier, Bitcoin is the first cryptocurrency ever to be invented. Being the first, it is also the one reigning over the cryptocurrency empire. At present, the exchange rate of Bitcoin is $16659.99. And this number is only going to go up. The reason being that it is not going to inflate. The total number of Bitcoins to remain in circulation ever will not exceed 21 million.

The popularity of Bitcoin is so much that companies have started accepting payments in Bitcoin rather than cash and cheques. And rightly so, because there is no intervention from any third party. This makes doing a transaction using Bitcoin one of the most secured and full proof method.

However, with so many advantages, it would be really amusing if there weren’t any disadvantages. One of them is that it gets harder to mine Bitcoins with each passing day. Earlier, when it was just invented, people having computers with fairly decent specifications could mine profitably. But, after every four years, the reward halves for mining a new block. And as more and more people start mining using increasingly powerful hardware, it is not profitable anymore for home users to mine Bitcoin. Earlier, there was a workaround to this problem by using the method of pool mining. In this method, a group of people mine a single block. After which the software refers to their contribution to distribute the reward amongst them. But, even this method is turning out to be unprofitable with time.

What is the solution then? Should we give up on a currency which is potentially the future in this era of the internet? No. Because we have alternatives.

Litecoin

Introduced way back in 2011, Litecoin is one of the first successors of Bitcoin and an early player in the cryptocurrency arena. It was invented to reduce transaction time compared to Bitcoin and also enable faster block generation. Also, powerful CPU is necessary to mine Litecoin whereas a GPU is necessary to mine Bitcoin. Thus, it became the choice for those who weren’t able to mine Bitcoin anymore. However, its downside was that it had lesser trust and thus lesser acceptance than Bitcoin. But, with an exchange rate of $152.28, it is still a contender in the market.

Ethereum

Ethereum is more than just an alternative to Bitcoin. In order to run the programs of decentralized software, Ethereum uses the blockchain technology. What that means is that it has become a place to not just exchange cash but also process code. And people buy Ethereum instead of Bitcoin. The essence is the same but the currency itself is different. 1 Ether is equal to $458.86. This is much less when compared to Bitcoin. But, the advantage is that it is still profitable to mine Ether.

The way in which the blockchain technology is used is the main difference between Ethereum and Bitcoin. Earlier, blockchain technology was only used for currency. However, there are myriad applications of this technology such as electronic voting, trading, and even digitally recorded property assets.

The Current Scenario

The current scenario of cryptocurrency is more like an all-in-one soup rather than a layered sandwich. What this means is that there are too many options out there (more than 700!). It is pretty difficult to decide upon one to take up and put effort on.

On one end we have Bitcoin which is authentic and has a high exchange rate but is difficult to mine, and on the other hand, we have Ripple and others which are relatively easier to mine but have pretty low exchange rates.

The list of cryptocurrencies we mentioned above is not at all exhaustive. The scope of this article is not enough to select a few and compare them.

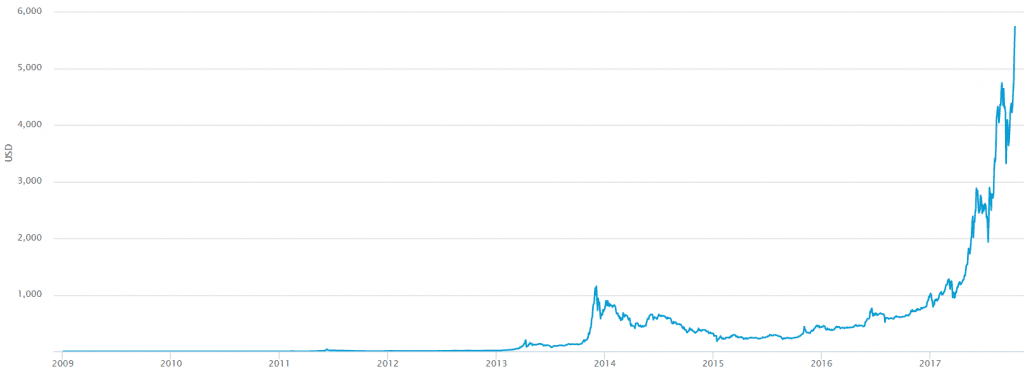

But, one thing to take note of is that the speed with which cryptocurrencies have gained popularity. In a short span of 8 years, Bitcoin has gone from just a project on SourceForge to a full-blown hype. From this alone, one can imagine what would be the scenario in the near future. Even though Bitcoin has had ups and downs, the overall trend in rate has been an increasing one. And this rate of increase is only increasing more and more.

However, no one can be sure if this is a rocket shooting for the moon or a bubble which has blown to its limits. Only time will tell what will happen to Bitcoin and other cryptocurrencies.

Conclusion

A few thousand words are not enough to completely explain cryptocurrency. However, we have still tried to explain the basics of it. This should be enough to make head and tail of things you read on the internet and keep up with the technology itself.

Although we have explained a couple of things, we have left out the method to actually mine cryptocurrency. We have also left out the comparison between various currencies and some profitable ones to mine. Keep on the lookout for more articles from us in this cryptocurrency series of articles. We plan to explain how to actually mine in a step-by-step guide in the upcoming article.

Also read: The birth of World Wide Web